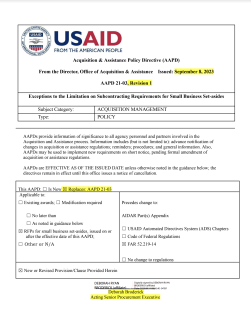

AAPD 21-03 Revision 1: Exceptions to the Limitation on Subcontracting Requirements for small business set-asides

AAPDs provide information of significance to all agency personnel and partners involved in the Acquisition and Assistance process. Information includes (but is not limited to): advance notification of changes in acquisition or assistance regulations; reminders; procedures; and general information. Also, AAPDs may be used to implement new requirements on short-notice, pending formal amendment of acquisition or assistance regulations.

Subject Category: Acquisition Management

Issued: September 8, 2023

Purpose: This revised AAPD:

This AAPD applies ONLY to awards (including task orders) that are partially or fully set-aside for small businesses such as:

- small business set-asides issued directly to small businesses above the simplified acquisition threshold (see FAR part 19);

- awards under the 8(a), HubZone, women-owned small business (WOSB) and service-disabled veteran owned small business (SDVOSB) programs, regardless of dollar value (see FAR 19.8, 19.13, 19.14 and 19.15).

- IDIQs that allow for Task Orders to be set-aside (or reserved) for small businesses.

This AAPD notifies COs of exemptions from the limitation on subcontracting requirements available to USAID contractors under the FAR class deviation #M/OAA-DEV-FAR-21-02c. The exemptions are authorized by the Small Business Administration (SBA) in 13 C.F.R. § 125.6, and will be included in the FAR through the rulemaking process. The deviation excludes the following types of work from the percentage of work that must be performed by a similarly-situated small business concern pursuant to the revised FAR 52.219-14: (i) other direct costs, to the extent they are not the principal purpose of the acquisition and small business concerns do not provide the service; (ii) work performed outside the United States on awards made pursuant to the Foreign Assistance Act of 1961; and (iii) work performed outside the United States required to be performed by a local contractor.

This deviation also provides clarity on how small businesses should treat independent contractors for purposes of the limitations on subcontracting requirements, as provided in the SBA’s final rule revising 13 C.F.R. § 125.6, published in the Federal Register on November 29, 2019 (84 FR 65647)

Required Actions (to be taken on or after September 10, 2021):

For contracts awarded under FAR Part 19, COs must include the deviated clause 52.219-14 in solicitations and resultant contracts for the following:

- Contracts expected to exceed the simplified acquisition threshold, when all or any portion of the requirements is set aside for a small business;

- Contracts set aside or awarded on a sole-source basis under the 8(a), HubZone, WOSB or SDVOSB programs, (see subparts 19.8, 19.13, 19.14, or 19.15) regardless of dollar value.

- Contracts awarded using the HUBZone price evaluation preference. However, if the prospective contractor waived the use of the price evaluation preference, or is other than a small business, COs must NOT insert the clause in the resultant contract.

- That are IDIQs that allow for orders to be set aside for small business concerns, as described in FAR 8.405-5 and 16.505(b)(2)(i)(F), and when orders may be issued directly to a small business concern as described in 19.504(c)(1)(ii). COs must indicate in paragraph (f) of the clause if compliance with the limitations on subcontracting is required at the contract or order level.