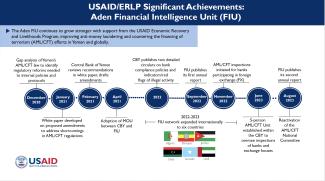

Signaling its growing strength in fighting financial crime, Aden’s Financial Intelligence Unit (FIU) published its second annual report in August with support from USAID’s Economic Recovery and Livelihoods Program (ERLP). The report provides an overview of the Unit and its activities in the global effort to combat terrorist financing and money laundering—the fuel used by drug dealers, terrorists, arms dealers, and other criminals to power and expand their operations. The report is just the latest in a series of significant achievements stemming from this collaboration.

Established in 2019 in Aden, the Unit serves as a central hub for receiving, analyzing, and disseminating financial intelligence related to suspicious transactions and activities. Since 2020, USAID ERLP experts have been working closely with FIU head, Mr. Basem Dabwan, and his team to establish the foundation for the Unit to function effectively and to align its oversight activities with best practice requirements for international anti-money laundering/counter financing terrorism (AML/CFT) initiatives.

By helping Aden’s Financial Intelligence Unit meet its primary objectives of identifying patterns, trends, and anomalies within financial data that may indicate connections to criminal and terrorist activities, USAID ERLP's collaborative efforts are enhancing the Unit’s financial intelligence capabilities and demonstrating USAID’s commitment to fostering regulatory compliance and integrity within Yemen’s financial system. They also reflect the Unit’s commitment to the Financial Action Task Force (FATF), a leading intergovernmental G7 initiative that sets AML/CFT standards and monitors their implementation.

USAID ERLP initiated its support to the Unit in 2020 with an analysis of Yemen’s AML/CFT law, which identified areas in need of revision in order to meet FATF standards. The analysis and its recommendations were reviewed with the Unit’s staff, producing key amendments to address shortcomings in the law. In 2021, USAID ERLP experts assisted the Central Bank of Yemen (CBY) to update two detailed circulars to effectively address these shortcomings. Both were published in 2022. The first provided instructions on bank compliance policies necessary to meet AML/CFT requirements, and the second provided precise indicators and red flags related to human trafficking, sexual exploitation, and insurance fraud schemes.

Through cooperation with USAID/ERLP, the FIU has addressed legislative and legal gaps, resulting in an improved business environment and heightened transparency and integrity,” said Mr. Dabwan.

The CBY distributed the circulars to banks and financial institutions, requiring them to classify clients according to the risks posed, in strict accordance with FATF standards, and to submit detailed annual reports evaluating any such risks they had been exposed to and related mitigation strategies.

USAID ERLP has also supported:

- Establishment of a five-person AML/CFT unit within the Central Bank of Yemen to oversee inspections of banks and exchange houses. This included in-depth training on inspection techniques and how to provide corrective measures to banks.

- On-site inspections of banks participating in foreign exchange (FX) auctions to evaluate potential suspicious activities or transactions.

- FIU’s adoption of AML/CFT procedures and mitigation measures related to FX auctions, providing a major additional incentive for bank compliance with reporting requirements.

- Proactively assisting the Unit in the publication of its first annual report (Sept. 2021).

- Expansion of the Unit’s national and international network, including adoption of Memoranda of Understanding (MOUs) between the Unit and the CBY, as well as between the Unit and Yemen’s Customs Authority, to streamline the exchange of information between these authorities.

- The signing of information-sharing MOUs with the FIUs in six countries: Algeria, Ethiopia, Jordan, Libya, Somalia, and United Arab Emirates.

This strategic support for enhanced compliance has been complemented by targeted capacity development for the Unit’s staff as well. This included a training-of-trainers program for seven Unit staff to establish an in-house team of experts qualified to deliver specialized training to government authorities and boost their capacity to conduct thorough financial investigations. USAID ERLP also recently conducted an in-depth workshop with members of Yemen’s AML/CFT National Committee to further enhance their knowledge of the key risks associated with non-compliance with core AML/CFT procedures.

Aden’s FIU is committed to presenting itself in the best possible light, adhering to the highest standards and qualities. It looks forward to further enhancing its positive image through continued partnership and cooperation with USAID/ERLP.”- Aden FIU head, Mr. Basem Dabwan